dLocal: Diving deep on long-term economics

In this post, I dive deep into the long-term economics of dLocal. In my first deep dive, I presented the high level investment case; this is more detailed with focus on unit economics.

The stock market can be an exceedingly volatile place over the short-term; right now, the market is concerned about the long-term economics in dLocal due to declines in net take rate. I believe that the market’s concern about long-term unit economics driven by short-term take rate declines is simply not correct.

For long-duration growth (10 years) in a business to be realized, the business must have aspects of growth which are self-reinforcing. Put simply, a business that becomes more valuable to its customers with increased scale has a unique property of self-reinforcing growth.

The potential for self-reinforcing growth, very high returns on capital, and very low expectations are what continues to drive my optimism in the long-term investment thesis behind dLocal.

Recent Challenges/Stock Market Performance

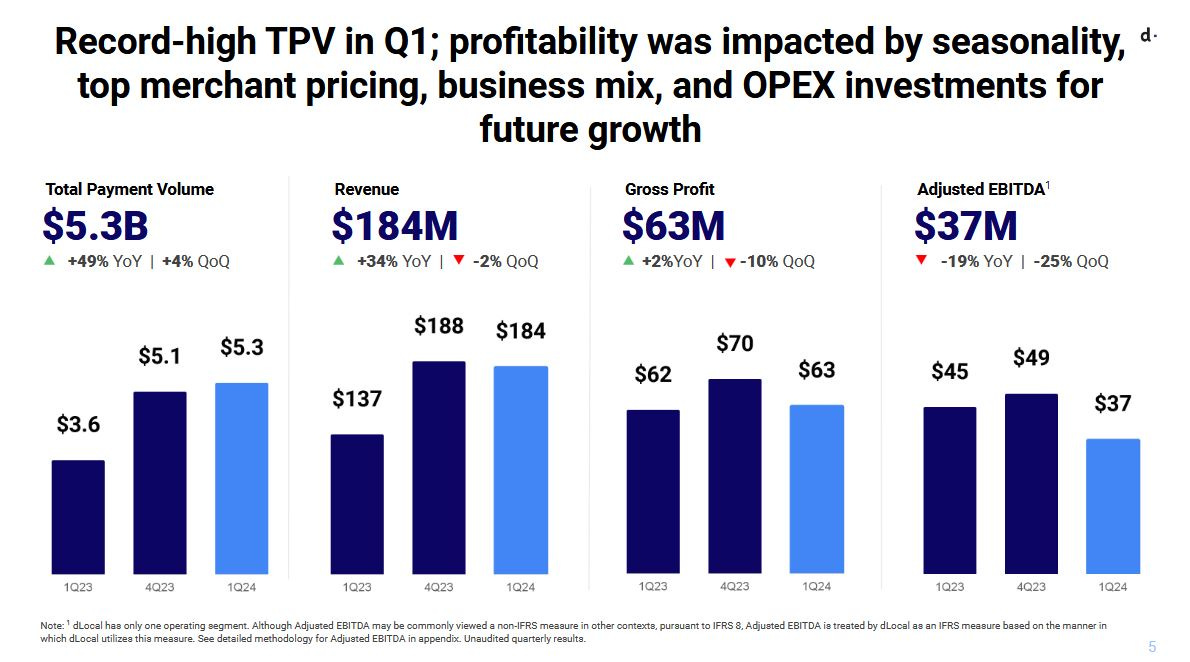

Shares of dLocal DLO 0.00%↑ have performed terribly over the last year; I will inspect the start of the share price decline in May 2024. This was primarily due to a tough Q1 2024 earnings report during which profitability was impacted significantly.

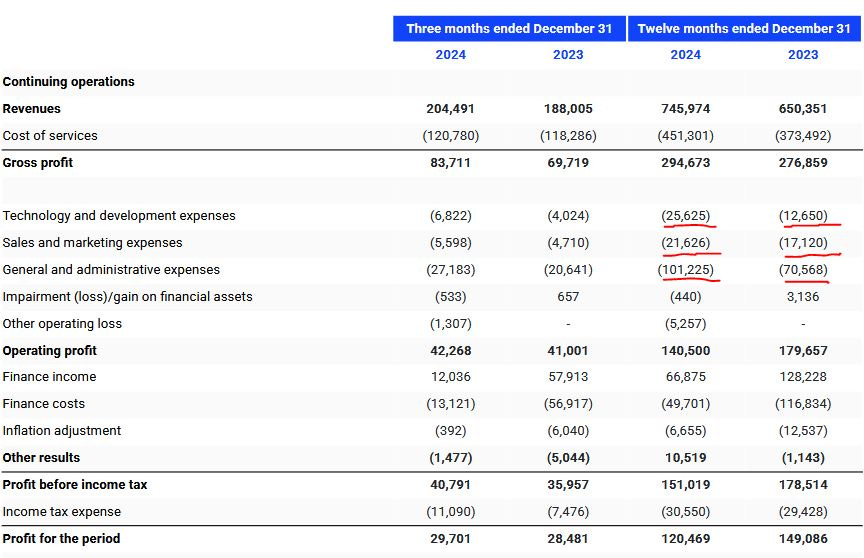

This earnings decline is best-explained by reviewing the FY2024 income statement with a focus on operating expenses.

Operating expenses increased by approximately $45 million dollars YoY. In Q4 2023, dLocal announced a significant increase in investment primarily focused on building out stronger engineering teams in order to allow the platform to continue to scale over the long-term.

The trajectory towards that mid-term guidance comes in for 2024 at around 70% Adjusted EBITDA over gross profit as we continue investing and tightening the foundations for long-term growth by 1) further strengthening the dLocal team, with particular emphasis on our engineering talent pool; 2) further upgrading back office capabilities and 3) continuing to invest behind our license portfolio throughout emerging markets. The combination of these actions will further widen our moat and continue to position DLO as the go-to payments platform to serve emerging markets. As we look beyond 2024, we believe that as we conclude our short-term investment cycle, we will start to see the operational leverage inherent to our business kick in. We steer our business for decades, not quarters. We continue to have a high conviction in our massive opportunity. (1)

Over a 2-3 year time horizon, dLocal’s management team expects the business to return to the historic Adjusted EBITDA / Gross Profit ratio exceeding 75%.

In addition to the short-term investment cycle driving increased operating expenses, profitability has been impacted by declines in take rates. dLocal has seen pressure in net take rate in 2024 driven by a significant repricing by dLocal’s largest merchant in Brazil/Mexico and other merchants increasing volumes and hitting lower pricing tiers in their contracts.

Consistent with the increase in engineering investment to drive future scalability, dLocal’s management team is willing to lower prices as part of a strategic priority to become scale leaders over the medium term. These management decisions are a reflection of two criteria which have not been well-understood by investors.

dLocal’s business is solving a massive problem in the world for emerging market consumers and the market opportunity is measured in the tens of trillions

dLocal’s business improves as it gets larger; I will enumerate this in more detail but management’s decision to push for scale is very rational

The massive problem dLocal is solving

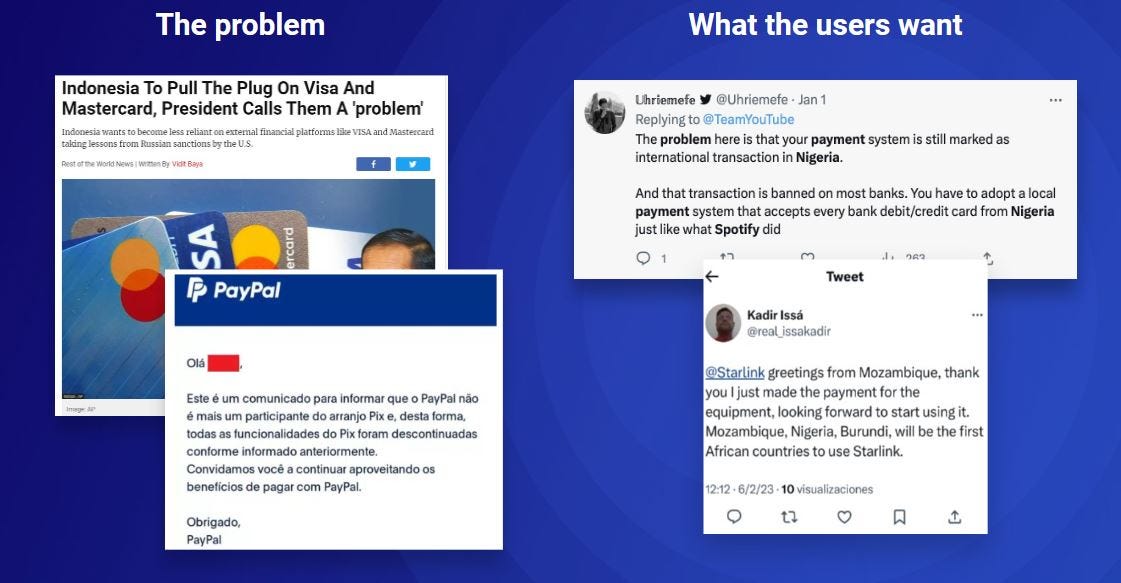

In order to fully understand the problem that dLocal is helping global/regional enterprises solve for emerging market consumers, we need to review international acquiring which is dLocal’s largest competitor.

Most of dLocal’s enterprise customers were previously using international acquiring and accepting international credit cards to process transactions. The most significant problem with international acquiring is simply that a large amount of emerging market consumers do not have access to international credit cards. This results in low conversion rates and lost revenue for merchants.

dLocal gives global enterprises access to accept payments from emerging market consumers from within the local banking system which is circumventing the need for international acquiring. Most importantly, dLocal is able to give its customers access to the local banking system which improves conversion rates significantly resulting in increased revenue to merchants.

“We weren't optimizing for how much we pay the provider. Obviously, we were mindful of it, and we took care of [company] expenses around this, but we really, really cared about advertisers. We really cared about how many advertisers we've got on our platform because we knew that once you were in and you were advertising and you saw the value of it, you would continue to advertise on [company]. So the cost of acquisition is so high that if I'm paying dLocal 2%, 3% or 4%, I mean, yes, 4% is a lot, but it's nothing compared to how much I'm getting from an advertiser.” (3)

Outside of increased conversion rates, dLocal is able to offer significantly lower prices than international acquirers. This is because dLocal is able to circumvent international acquiring fees by using local acquirers; so merchants end up increasing conversion rates and lowering payment processing costs.

“dLocal would be about 10% cheaper than EBANX, and they would be about 15% cheaper than like PPRO or allpago, a little cheaper now also against PayU, probably 5% to 10% cheaper. They are really the cheapest payment provider for high-volume processing in the region overall” (3)

dLocal management ambitions

Industry forecasts predict the retail cross-border payments market will reach $65 trillion by 2030. The market opportunity is massive and dLocal has a highly-disruptive technology as they are able to significantly increase conversion rates while lowering processing costs.

In terms of the size of the addressable market and the opportunity around payments, it really is probably the most significant piece of the investment thesis. Anytime you spend with global merchants, it becomes very clear that most of them except for the larger more sophisticated ones are still doing an important part of their global cross border through international acquiring. Many of them are only beginning to really leverage local payment methods, alternative payment methods, all of which will only increase adoption and usage across the global South.

So we are extremely optimistic on the potential for sustained high levels of TPV growth because we think the market will continue to generate tailwinds over a long period of time simply from the increased digitalization of the consumer across emerging markets. When you look at the mix shift of our business as it gradually moves towards countries that are newer in our portfolio and slowly moves away from the larger markets, I think that’s a very strong indication of how much opportunity still exists.

The share of our merchants overall wallet from those smaller markets is still very low and that will continue to grow. And also our ability to gain share from international acquiring in a growing number of markets is still very, very large.

dLocal’s FY2024 TPV was $26 billion; in comparison to the TAM measured in the tens of trillions there is still room for very significant growth. With respect to the size of the TAM, dLocal could grow TPV by 50 times into the trillions and remain a single-digit market share player in cross-border payments.

Management is thinking about the business in these terms and is consequently more focused on building the right foundation to support significant future growth. Near-term profits are not the right model of measuring progress; long-term growth in TPV is what will lead to scaled economies and very significant competitive advantages.

Long-term unit economics

As promised, we will discuss the long-term unit economics inherent to the business model.

Take Rates

I acknowledge that take rates will continue to decline as dLocal continues to scale. However, I do not believe that take-rate declines matter over the long-term and I believe that the market is placing an unnecessary level of importance on short-term declines in take rates. If take-rate declines were an indication of significant competitition driving merchant pricing negotiations, I would share some of the concern of the market. What has actually happened is dLocal’s merchants have increased their usage of the product and have consequently hit lower pricing tiers on contracts.

The most important consideration when considering take rates is that 50% of dLocal’s transactions are cross border and dLocal is able to earn FX fees. dLocal is circumventing international acquiring where players like Visa/Mastercard typically earn 1-2% FX fees. Given dLocal is lowering costs by using local acquirers, I believe that dLocal should be able to continue to earn their FX fees on 50% of TPV and will attribute an approximate 100bps net take rate floor on this portion of the business.

Continuing to local-to-local, Stripe take rates in developed economies is estimated in the 30-45bps range and Adyen’s are published in the 20bps range. I will attribute 30bps net take rate floor on this portion of the business.

The combined net take rate floor nets out to the .65% range which I believe could reflect net take rates over the long-term if dLocal is able to scale to the size of an Adyen/Stripe. I do not believe it is reasonable to assume take rate declines to this extent into the medium term but as a worst-case scenario returns can still be satisfactory.

FX Economies of Scale

dLocal is in a position of having both pay-ins (transactions entering markets) and pay-outs (transactions leaving markets) within cross-border transactions. As dLocal continues to scale the platform, increases in transaction volumes can help match pay-ins to pay-outs and in some markets where regulators permit introduces potential for “netting.”

In the context of cross-border transactions, netting refers to the process of offsetting or consolidating multiple payment obligations between parties to simplify and reduce the overall number of transactions and payments. dLocal currently uses netting on a very small amount of transactions but over time there is significant opportunity to improve unit economics via netting. Netting allows for dLocal to provide lower FX rates and take an increased FX spread as currency conversion only needs to be applied to the net transaction amount.

Just trying to make sure we have the right numbers there. Okay. So as you’ve seen, the remittance business is a newer business for us. Remember, we don’t touch end consumers. We’re a provider of remittance infrastructure for merchants or financial service verticals that offer remittances to end users. So it’s extremely fast growing, very successful. In terms of absolute size. You have the TPV there, but that leads to about 4% of our repatriations currently being done through netting. So it’s still small. What the netting allows us to do in markets where it’s regulatorily allowed is it gives us very competitive rates on the FX because we don’t have to go through our global banking relationships or brokers. We can simply net.

Again, it’s still at 4%, growing very fast over time. If those netting corridors grow, that makes us more competitive in terms of FX, so we can win more business and it also improves the FX spreads. If the market is an extremely competitive FX market, then the impact to gross margin is not that relevant because the amount you can improve is not that big. In markets where exotic currencies are being traded and we do a lot of those, the netting could be very significant in terms of the incremental gross profit it allows for us. And we’ve seen that sporadically over time with the Argentina case or the Egypt case. (4)

Acquirer Aggregation Economies of Scale

dLocal is not an acquiring bank but partners with acquiring banks in the markets that dLocal supports. dLocal functions as a demand aggregator for a set of many different local acquirers.

dLocal will be able to continually negotiate costs with acquiring bank partners as the platform grows and therefore can continually lower processing costs; preserving net take rate while lowering gross take rate. Recently, declines in gross take rates have outpaced improvements in processing costs so this has not had as significant impact on financial performance. However, management has also commented on this dynamic and I believe that it is overlooked from a strategic perspective by the market.

Yes. So on the first one, we really see the importance of not getting caught up in short term worries about take rate, but the importance of continuing to gain scale to drive down processing costs over the long run, winning merchant contracts in markets where we compete in an RFP or where they ask us to add a market, understanding that over time you can then leverage those relationships across more and more markets.

And again, I go back to the sustained TPV growth over a long period of time, we think is the single most important metric of success right here. And take rate is almost an output and not an input. The input we try to manage for is how do we win as much volume from our merchants as possible, obviously reflecting in the pricing the value that we add to them and what the underlying cost structure is and understanding that the scale leader here over the longer period of time will be able to drive down the most cost from its processors. (5)

Structural Operational Leverage

The takeaway for me as an investor is that despite near-term pressure take rates and a short-term investment into engineering talent to support future scale, dLocal is a business with structural operational leverage. Setting up new markets requires fixed cost technical and operations investment; however dLocal’s business model has no variable costs.

There is significant potential for margins to continually increase as a percentage of gross profit as the business scales. This is very common to the payments industry when reviewing the long-term economics of an Adyen, Visa, or Mastercard.

The previous gross margin structure of the busines may never be achieved again; however, I am very confident that we will continue to see the Adjusted EBITDA/Gross Profit metric improve year after year.

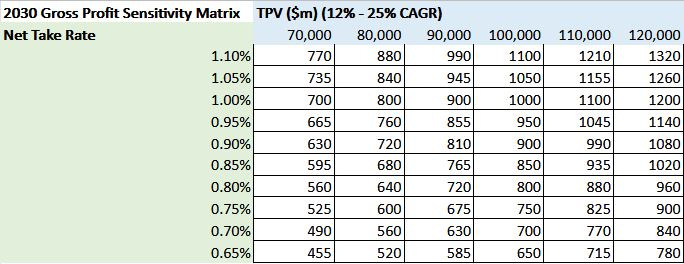

Sensitivity Matrix

I wanted to demonstrate how take rate declines and TPV growth rates will affect gross profit and consequently the valuation of the business in 2030. The growth rates in TPV range from 12-25% CAGR from an estimated $35 billion in FY2025 base — even the high end of this range feels quite conservative to me.

We can see clearly that if we assume both an extreme TPV growth rate decline from the current 45% YoY rate to 12% for the next five years and a drastic 45bps decline in net take rate we still end up with modest growth in gross profit over the coming years which would still result in an enterprise value of $4 billion using historic profitability of 75% Adjusted EBITDA/Gross Profit and a 12x Adjusted EBITDA multiple. For me, this would not be a great result over the next five years but most importantly capital will be preserved.

However, if we are more optimistic that the TPV growth over the next five years is closer to the 25% range and the take rate decline is more modest in the middle of the provided range it is very easy to see a $15-20 billion dollar enterprise value which is simply an incredible return from the current market cap.

Concluding Thoughts

I would like to be very clear; dLocal is still in the process of developing a strong competitive advantage in cross-border payments. However, the building blocks are very clear to me and my research into the company’s culture indicates dLocal is one of the fastest-moving and most motivated companies I have found.

The company’s culture is ultimately the driver of execution and consequently success over the long-term. I continue to believe that dLocal has an extremely promising decade of robust growth to come and maintain my conviction in the long-term thesis.

These building blocks allow me to completely disregard short-term price fluctuations as I understand that the company has an incredible product, incredible customer retention, and a truly massive addressable market. I trust that in time this tremendous customer value will result in value accrued to shareholders over an appropriate time horizon. I remain patient as the market is a weighing machine in the long-term; business performance will ultimately determine returns.

If you enjoyed this and would like to learn more about dLocal — read my full thesis:

dLocal: An asymmetric opportunity with significant upside potential

If an investor could dream of the perfect business in which to invest, what qualities would they search for? This question has been answered, rather definitively, by many great investors including Warren Buffet, Chuck Akre, and Joel Greenblatt.

Appendix

https://investor.dlocal.com/wp-content/uploads/2024/03/4Q23_Earnings-Results.pdf

https://investor.dlocal.com/wp-content/uploads/2023/06/Investor-Day-presentation.pdf

https://valueinvestorsclub.com/idea/DLOCAL_LTD/4720760162

https://www.insidermonkey.com/blog/dlocal-limited-nasdaqdlo-q1-2024-earnings-call-transcript-1303713/

https://seekingalpha.com/article/4763220-dlocal-limited-dlo-q4-2024-earnings-call-transcript

Disclaimer:

The content provided on this blog is for informational purposes only and should not be construed as financial, investment, tax, or legal advice. All information, data, and material presented herein is believed to be accurate and reliable, but should not be regarded as a complete analysis of any subjects discussed.

All investments involve risk, and the past performance of any investment, investment strategy, or investment style is not necessarily indicative of future results. The value of investments can go down as well as up, and investors may not recover the amount originally investe

The author(s) of this blog are not licensed financial advisors, registered investment advisors, or registered broker-dealers. We do not purport to tell or suggest which securities or investments readers should buy or sell for themselves.