Crocs: Ugly shoes, great business, incredible price

Crocs? Those ugly plastic shoes? Well let me tell you, making ugly plastic shoes is a great business.

As I go through my screening process looking for new ideas I am incredibly quick to pass. There are so many things to avoid, low returns on capital, high stock-based-compensation (SBC), too much leverage, etc.

When I looked at Crocs inc. I assumed that the returns on capital business would be poor. After all, they just make plastic shoes.

What’s the competitive advantage there?

To my significant surprise, making plastic shoes is a great business and Crocs inc. has a nuanced competitive advantage. I need to stop my software engineering career and move into the plastic shoes business, apparently.

Let’s dive into the details.

Contents:

Business Model Overview

Growth Potential

Catalyst

Evaluation of Management Quality

Valuation

Risks

Concluding Thoughts

Business Model Overview

Crocs inc. is an American footwear company that manufactures, markets, and sells Crocs brand foam shoes. The company is known for its iconic “clog” but sells a variety shoes such as flats and sandals.

Crocs inc. recently expanded beyond the Crocs brand and now operates HEYDUDE, a similar brand for lightweight footwear (we will touch more on this acquisition later).

Revenue Streams:

Direct to consumer (DTC) Sales — Sales through company-owned retail stores, Crocs.com, and as a third-party-seller on Amazon.com. This is higher margin and represents approximately 56% of Crocs brand revenues per Q3 2024 earnings (1).

Wholesale — Sales to third-party retailers and has distribution through footwear department stores, shoe stores, and select online retailers. This is lower margin and represents approximately 46% of Crocs brand revenues per Q3 2024 earnings (1).

Key Operating Costs:

Cost of Goods — Includes raw materials, manufacturing equipment, and inventory production costs associated with procuring inventory for DTC and wholesale sales.

Marketing — Paid marketing campaigns to promote Crocs brand and HEYDUDE products.

Crocs inc. is able to generate significant margins despite selling in a low-price category with significant competition. Crocs inc. is in an enviable position of both having a strong brand and being the low-cost producer in the lightweight footwear category. This is primarily due to the unique/simple design of the clog, which results in lower production costs compared to similar lightweight footwear products.

Low Production Costs

Simple, lightweight material (proprietary Croslite foam)

Minimal manufacturing complexity

Inexpensive raw materials

If we closely examine the iconic clog, the entire shoe is essentially a foam-mold and the heel strap on the back which is attached with rivet buttons. This is incredibly simple and as we previously discussed — can be manufactured at low cost.

Returns on Capital

Consequently, Crocs inc. has very high returns on capital employed (ROCE). As investors, we should never blindly assert that a company has a competitive advantage — if there is a competitive advantage we should be able to clearly see it in the numbers.

Here’s a rough calculation using Q3 2024 annualized EBIT (2):

ROCE = (EBIT) / (Total Assets - Current Liabilities)

= $1.08 billion / ($4.7 billion - $0.7 billion)

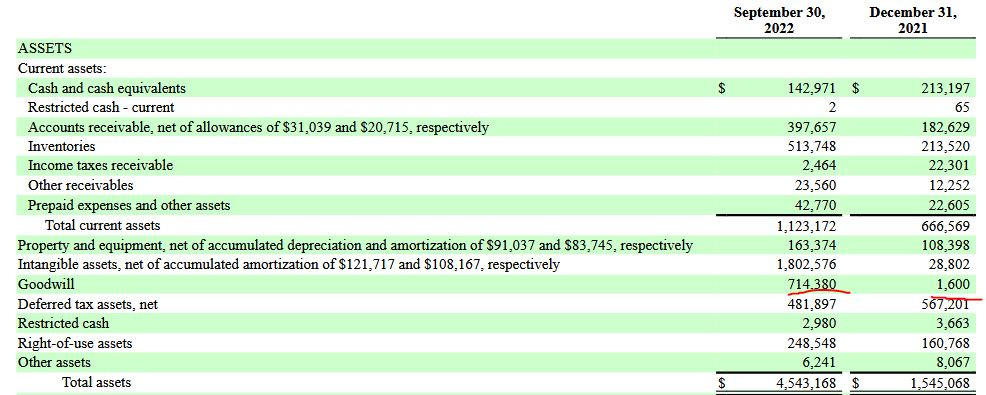

= 27%This is pretty strong. However, I noticed that Crocs inc. took a significant Goodwill impairment in December 2021 due to the HEYDUDE acquisition which is obfuscating the underlying strength of the Crocs brand business.

If I exclude this Goodwill impairment and reduce EBIT by $200 million (HEYDUDE is generating $800 million in revenue with lower profitability than the ~25% EBIT margin for Crocs inc.) we can see a very rough estimate for ROCE calculation of the Crocs brand.

# Adjusted 2024 ROCE

ROCE = (EBIT) / (Total Assets - Current Liabilities)

= $800 million / ($4.7 billion - $2.5 billion - $0.7 billion)

= 46%

# Checking my work with pre-acquisition 2021 ROCE

= $567 million / ($1.545 billion - $0.388 billion)

= 49%The Crocs brand is an incredible business. I told you we can see it in the numbers, right?

Growth Potential

Crocs inc. has a few growth drivers that should help the business to be able to consistently grow at least at a modest pace. In order to evaluate growth potential I will isolate the business into Crocs brand North America, Crocs brand International, and HEYDUDE.

Crocs brand North America — This segment of the business is very mature but has some pricing power given the premium placement of the brand in lightweight footwear. Consequently, I expect Crocs will be able to grow in North America with the rate of inflation.

Crocs brand International — The Crocs brand is still somewhat early in its international expansion and is growing at 17% YoY as of Q3 2024. The Crocs brand should be able to continue to grow more significantly internationally.

HEYDUDE — The HEYDUDE brand is very early and still has significant runway to grow, if successful. Creating traction for a new brand is very difficult however the brand indicators I can identify suggest that the brand is growing.

In my view, there is justification to believe that Crocs inc. will be able to maintain decent growth of at least 5-7% over the next decade when considering solid performance in Crocs brand North America, growth in Crocs brand International, and a rebound in growth for HEYDUDE. Crocs management has far more ambitious growth targets but we should avoid making assumptions that rely on the whims of fashion trends.

Catalyst

When considering the purchase of deep-value positions such as Crocs inc. it is important to consider why the business is on sale for such a low price. The market is generally — but not always — efficient, such a price is most often for good reason.

Crocs inc. is currently in a unique financial position as the Crocs brand is delivering strong growth — growing revenues 8% YoY as of Q3 2024 earnings (1). However, revenue growth for the company is a measly 2% YoY as of Q3 2024 earnings (1).

This is due to an aggressive over-expansion of the HEYDUDE brand — Crocs inc. oversold HEYDUDE inventory wholesale to distribution partners in 2023. This led to excess investory and consequently HEYDUDE distribution partners are right-sizing inventory which is causing a significant (17)% YoY contraction in HEYDUDE revenues. As I previously showed, the HEYDUDE brand is showing signs of growth so in the coming years HEYDUDE revenue growth should accelerate.

My conclusion here as an investor is that temporary headwinds in HEYDUDE are overshadowing what is an excellent business in Crocs brand. Therefore, normalization of HEYDUDE inventory and a return to growth in HEYDUDE will significantly improve financial performance. This should lead to multiple expansion — Crocs inc. is far too strong a business to trade at 6x EBIT.

Evaluation of Management Quality

In my view, the primary responsibility of a management team is to make capital allocation decisions. Capital allocation decisions are very important and I need to ensure that capital is being allocated effectively. I also look for management teams with significant ownership of the business to ensure that management incentives are aligned with shareholders.

Capital Allocation

Crocs inc. management has published a capital allocation framework:

Invest in the business and drive growth

Deleverage from HEYDUDE acquisition

Share repurchases

Share Repurchases

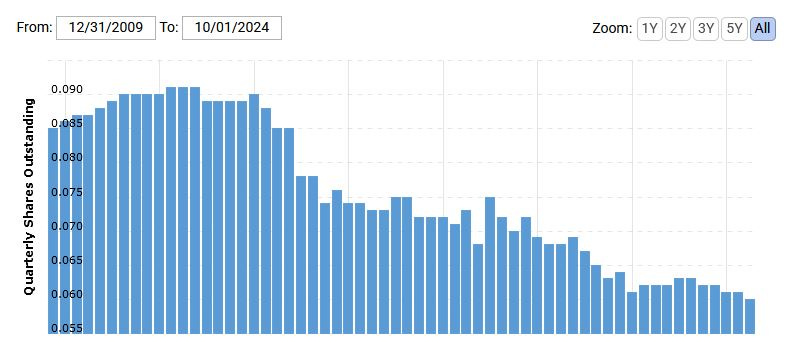

Crocs inc. has consistently allocated capital to repurchase shares. This is something I love to see from a management team and strongly prefer to dividends for tax-efficiency.

Crocs inc. generates very strong cash flow and after deleveraging from the HEYDUDE acquisition share buybacks will continue at a more accelerated pace.

HEYDUDE Acquisition

The market is extremely negative about the HEYDUDE acquisition. While I strongly dislike large acquisitions, I will approach an evaluation of this acquisition rationally and try to determine:

Was the acquisition made under attractive terms?

Has the acquisition been value-accretive?

The management team made the HEYDUDE acquisition in 2021 and paid 15x EBITDA for a total of $2.5 billion. We can infer that HEYDUDE was generating around $170 million in EBITDA on ~$600 million in 2021 revenues. From the 2021 acquisition, revenues have increased to $800 million despite the significant contraction in 2024.

The acquisition was funded using 20% shares and 80% debt with an effective ~6% interest rate. As previously discussed, HEYDUDE was generating around $170 million in EBITDA and the interest burden on the debt issued was ~$115 million (5). The shares were issued at all time highs at $180 per share with a ~5% EBITDA yield which is less than the ~7% EBITDA yield acquired through HEYDUDE. Shareholders didn’t have to pay any cash to acquire HEYDUDE.

However, the opportunity cost of the acquisition is the cash flow used to deleverage the company instead of repurchasing Crocs inc. shares. I dislike this acquisition but it was made on favorable terms and the long-term growth of the HEYDUDE brand over time will be the real determining factor as to whether the acquisition has been value-accretive. As aforementioned, there is at least some reason to believe that HEYDUDE can continue to grow so it is still too early to form a rational conclusion.

Crocs Turnaround

Andrew Rees became the CEO of Crocs inc. in 2017 and made significant changes to the business that have resulted in an impressive turnaround.

The elaborate (simple) plan:

Invest in the classic clog

Create brand relevance through digital marketing

Emphasize digital storefront and consolidate brick and mortar retail

“The company historically had started to diversify away from the Classic Clog. But we thought that was wrong. So we put our product, graphic and style innovation back into [the silhouette], because that’s the core of the brand. It’s also our most profitable product arena. We refocused on the Classic Clog and almost exclusively on molded product, which is our DNA. That’s what we do best. That’s what nobody else does well and that’s where we could win.”

Since Andrew Rees has taken the helm in 2017, shareholders have earned a 39% CAGR. The Crocs brand turnaround is an impressive data point and gives me at least some tempered optimism with HEYDUDE moving forward.

Insider Ownership

Crocs inc. insiders own a cumulative 2.72% of shares outstanding (2). For what I like to see, this is on the low side and not a strong indication of great incentive alignment. I always dive deeper and will review the compensation policy of Andrew Rees. Rees has two key incentive programs which account for 69% of his total compensation:

Long-Term Incentives:

The long-term incentive program is based on growth in revenues and Adjusted EBITDA operating margin. This is based on cumulative performance over three years.

Short-Term Incentives:

The short-term incentive program is based on EBIT and FCF for the operating year.

Andrew Rees was paid ~$10 million in 2023 of which the majority — $7.2 million is in company stock. In addition, Andrew Rees owns 1.64% of shares outstanding worth around $100 million. My view is this compensation package is reasonable compared to other companies in the industry and Andrew Rees is highly aligned with shareholders given his $100 million equity stake.

I’m also a fan of Andrew it’s a great name.

Valuation

My approach to valuation is simple — I would rather be roughly right than precisely wrong. Therefore, I intentionally avoid using complex models such as DCF as experience has taught me the number of assumptions required as input can lead to justification for any price. If I need a spreadsheet to figure out that it’s a good deal, the margin of safety isn’t high enough for me.

In order to value Crocs inc. I will make a projection of EBIT over the next 5 years and estimate market cap in 2030. This will require the following assumptions:

Growth Rate

Terminal Multiple

I am accelerating growth from the current rate of 2% because Crocs inc. is currently in a unique situation that is depressing revenue growth. Management ambitions are my bull case and I am tempering expectations from there. For reference, 7% is matching historic growth of the Crocs brand from 2010-2020.

Bear: 5% Growth Rate, 8x EBIT - $10.2 billion

Base: 7% Growth Rate, 10x EBIT - $14.0 billion

Bull: 10% Growth Rate, 13x EBIT - $20.9 billion

In addition, we need to consider share repurchases considering that Crocs inc. is reducing share count by ~3.3% YoY (1). In all of the cases I have presented, Crocs inc. should be able to reduce share count by at least 2% annually (this is very conservative compared to historic share count reduction). This results in a 2030 fully diluted share count of ~53.9 million shares from the ~59.6 million shares today.

I will update my 2030 projections on a per-share basis so I can give investors an idea of the distribution of returns here. All CAGR calculations are from a share price of $100.

Bear: $10.2 billion, $189 per share, ~13% CAGR

Base: $14.6 billion, $259 per share, ~21% CAGR

Bull: $20.9 billion, $387 per share, ~31% CAGR

This is an attractive distribution of returns. The worst-case scenario is still attractive and returns improve significantly from there. As an investor, I invest exclusively in these type of risk-distributions.

Risks

Consumer Discretionary Pressure

As inflationary pressures persist and consumers face increased costs across essential categories, discretionary spending on comfort footwear may decline. Crocs inc. positioning as a lifestyle brand rather than a necessity makes it vulnerable to shifts in consumer spending patterns during economic downturns.

Travel and Experience Economy Dependency

Crocs inc. has successfully aligned itself with leisure activities and travel experiences, making the brand susceptible to broader tourism and entertainment industry cycles. Any prolonged downturn in travel or experience-based spending could impact sales, particularly in key tourist destinations and theme parks where Crocs inc. maintains significant retail presence.

Rise of Fast-Fashion Platforms

The emergence of platforms like Temu, Shein, and AliExpress present threat to the Crocs brand market position. These platforms offer similar styles at drastically lower price points, potentially eroding the Crocs brand value proposition.

The proliferation of knockoff products through these channels could lead to:

Decreased perceived exclusivity of Crocs brand designs

Potential damage to brand equity, particularly in premium positioning

Challenges in maintaining price against lower-cost alternatives

Nonetheless, knockoff products have been around for a long time and the Crocs brand has continued to be a great business (6).

Concluding Thoughts

Let’s not get ahead of ourselves here, do I think that Crocs inc. is going to be making a break as the next big market winner? Probably not.

However, it is hard to argue against the fact that Crocs inc.

Generates very high returns on capital

Has some long-term growth potential internationally

Is transitioning through HEYDUDE excess inventory

Returns significant capital to shareholders

Is available at an exceptional discount

Crocs inc. is an overlooked high-quality business at an incredibly low price. I think that the significant discount today compensates for HEYDUDE uncertainty or concerns about the durability of the brand/fashion trends. I do not currently own a position but am considering opening a position later this year.

Appendix

https://investors.crocs.com/news-and-events/press-releases/press-release-details/2024/Crocs-Inc.-Reports-Better-Than-Expected-Third-Quarter-Results-And-Adjusts-Full-Year-2024-Outlook/default.aspx

https://d18rn0p25nwr6d.cloudfront.net/CIK-0001334036/5006be27-1e98-42ca-8f57-7bdf9f8978cc.pdf

https://d18rn0p25nwr6d.cloudfront.net/CIK-0001334036/72cabbb9-e810-49a4-a16e-70aa3da829ee.pdf

https://d18rn0p25nwr6d.cloudfront.net/CIK-0001334036/368f41dc-af32-47cb-a32b-ebefe0cbc472.pdf

https://d18rn0p25nwr6d.cloudfront.net/CIK-0001334036/ad6f3108-99dd-4f30-b342-1e135e4deca5.pdf

https://www.businessinsider.com/crocs-sues-walmart-hobby-lobby-copycats-croc-shoes-clogs2021-7?op=1

https://www.yahoo.com/lifestyle/crocs-ceo-andrew-rees-leading-180702998.html

Disclaimer:

The content provided on this blog is for informational purposes only and should not be construed as financial, investment, tax, or legal advice. All information, data, and material presented herein is believed to be accurate and reliable, but should not be regarded as a complete analysis of any subjects discussed.

All investments involve risk, and the past performance of any investment, investment strategy, or investment style is not necessarily indicative of future results. The value of investments can go down as well as up, and investors may not recover the amount originally invested.

The author(s) of this blog are not licensed financial advisors, registered investment advisors, or registered broker-dealers. We do not purport to tell or suggest which securities or investments readers should buy or sell for themselves.

My kids refuse to wear anything except crocs summertime. I looked at crox as a company 2 years ago and totaly agree with Andrew's analysis

I realized I was wearing Crocs while reading this. )) I think you are on point. Crocs brand, supporting the whole business until the recent acquisition and operational issues are resolved. And the company is trading around 6.5 PE, basically negative growth expectation from the market.