Crocs: Q4 2024 Earnings Review

Crocs finishes FY2024 on a strong note with 3.1% revenue growth in Q42024 and a 20.2% operating margin.

Crocs inc. CROX 0.00%↑ reported earnings on 02/13/2025 for FY2024. This was a strong report to close out FY2024 with revenues growing 4% in FY2024 and EPS growing 9% in FY2024.

Notably, EPS growth significantly outpaced revenue growth without operating leverage which is primarily due to reduction in shares outstanding. The management team knows the stock is incredibly cheap and is using strong cash generation to buy back stock in huge chunks with a 7.4% reduction in share count in FY2024. With no growth and constant valuation Crocs inc. can continue to drive returns just from buybacks at these prices as evidenced by the 9% reported EPS growth.

Crocs inc. has started shifting capital allocation priorities from debt payment to share repurchases. Crocs inc. bought back $551 million of stock in FY2024 and repaid $323 million in debt. The buyback program has been increased to approximately $1.3 billion in total authorized outstanding repurchases.

Crocs inc. guidance for FY2025 is expecting revenue growth of 2-2.5% driven by 4.5% growth of the Crocs brand and a contraction in HEYDUDE revenues of 7-9%. Management expects operating margins to be relatively stable in FY2025 with a modest 60BPS impact from FX headwinds and proposed tariffs by the Trump administration.

Crocs Brand

FY2025 guidance for Crocs brand is in line with what my expectations were of around 4-4.5%. My view is that Crocs brand should be able to drive modest growth in North America relatively matching inflation and low double digit growth in the international segment over the medium term — management confirmed this over the earnings call.

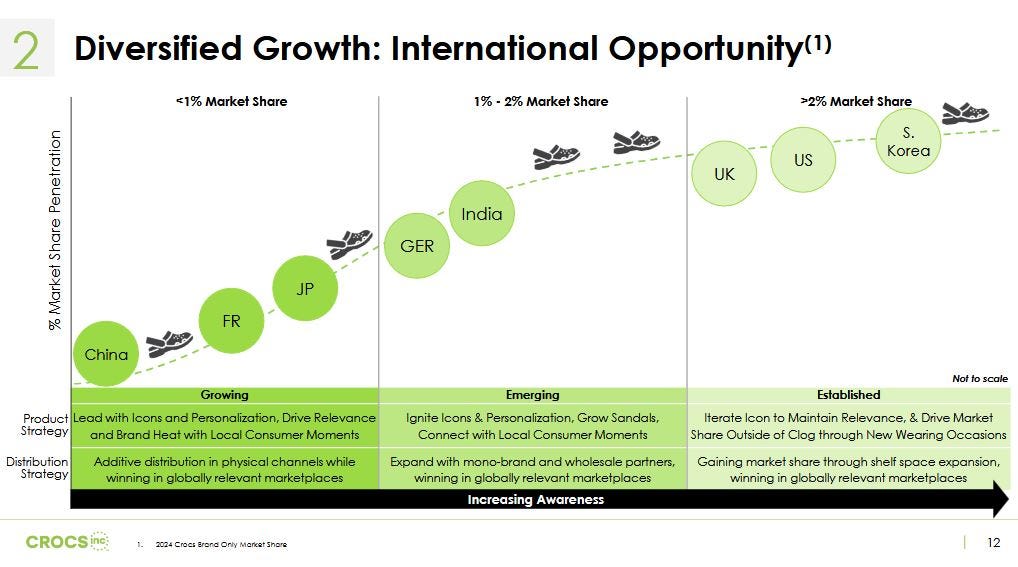

As we think about our growth opportunities beyond 2025, we believe we can continue to fuel growth in North America through iterating on our icon and expanding wearing occasions. With that said, we see the majority of our dollar growth coming from International. We're in earlier phase of establishing club relevance and see ample opportunity for market share gains.

Our average market share in major countries including China, India, Japan, Germany, and France represents approximately one-quarter of the market share we've achieved in our more established markets, the US, UK, and South Korea. All in, we have confidence in low-double-digit growth of our international business on a constant currency basis over the medium term.

I am very pleased by the guidance and have confidence in the Crocs brand over the long-term.

HEYDUDE

HEYDUDE is the reason the stock is so cheap — the market perception of the HEYDUDE acquisition is extremely negative. HEYDUDE revenues continue to be under significant pressure as wholesale distribution partners right-size their inventory.

However, the HEYDUDE brand continues to show signs of growth. DTC Sales actually increased 7% YoY in Q42024.

Overall, our direct-to-consumer channel was up 7% to prior year, marking the first positive inflection in five quarters.

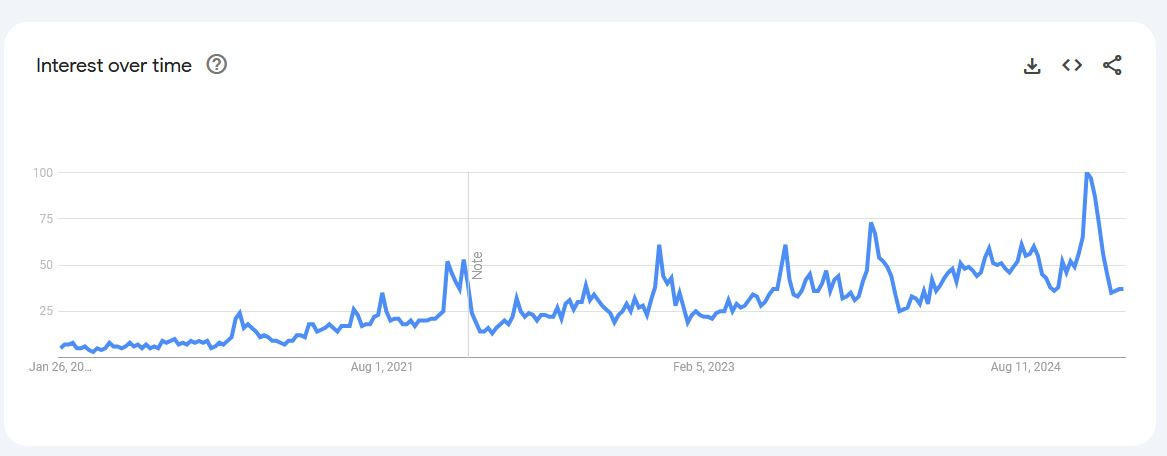

Over the month of December, HEYDUDE was the number three footwear brand on TikTok shop. Google trends also show that the HEYDUDE brand has traction.

Crocs inc. management continues to work through near-term HEYDUDE headwinds and guidance is for a significant 7-9% contraction for FY2025. However, the majority of the contraction is expected in the first half of the year and there is some potential for a recovery.

Management has not given commentary on when they expect for HEYDUDE to return to growth but management clearly has expectations for the inflection point to occur at some point in the relatively near future.

So I think hopefully we're doing that. I would say as we kind of look at the trajectory of the brand, we've done this before at Crocs. We really turned around that brand and – from a brand that was going no way years ago to a brand that's incredibly successful today. We know the playbook. We're seeing a lot of the green shoots. So we're very confident with what we're seeing and where we're going, so.

And I would say lastly from a HEYDUDE perspective, look, we think this is a great brand. We think it's well positioned against the consumer. It hasn't met our short-term expectations, but we remain extremely confident in its long-term potential, its ability to further penetrate the US market and leverage internationally.

HEYDUDE returning to even modest growth will be a significant catalyst for the share price to rerate over the near term.

Tariffs

Crocs inc. management provided very straightforward guidance on impacts from proposed tariffs by the Trump administration.

Before turning to guidance, I would like to address the topic of tariffs. Our guidance embeds an additional 10% tariff on goods imported from China into the US beginning February 4 as well as the anticipated additional 25% tariff on goods importing from Mexico beginning in March and assumes these will stay in place for the remainderof the year. We do not have any production in Canada.

In 2025, we expect the share of enterprise imports into the US from China to be approximately 15%, with Crocs at 10% and HEYDUDE at 27%. Our exposure to Mexico is expected to be under 4% and for the Crocs Brand only. For the enterprise, we estimate an approximate $11 million headwind to gross profit from these additional tariffs or roughly 25 basis points to our margin rate.

The proposed tariffs — if implemented — will have a 25 BPS negative impact on gross margins. Management does not anticipate any significant impact to operating margin so tariffs are not a significant concern for FY2025.

Concluding Thoughts

This was a strong end to a turbulent year for Crocs inc. Since Andrew Rees has become CEO of Crocs inc. in 2016, shareholders have earned a 39% CAGR. Rees has been able to take a stagnant Crocs brand and reignite brand relevance while streamlining operations resulting in significant cash generation.

Although I maintain some skepticism, I believe a strong recovery in HEYDUDE is possible and the management team has demonstrated they have the skills to execute.

Lucky for us as investors, the exceptionally low share price does not require a recovery for positive returns. HEYDUDE recovering is not priced into this stock at all, even after today’s significant move in stock price.

Did you enjoy reading my update and want to know more on my full thesis?

Crocs: Ugly shoes, great business, incredible price

As I go through my screening process looking for new ideas I am incredibly quick to pass. There are so many things to avoid, low returns on capital, high stock-based-compensation (SBC), too much leverage, etc.

Appendix

https://investors.crocs.com/news-and-events/press-releases/press-release-details/2025/Crocs-Inc.-Reports-Record-2024-Results-with-Annual-Revenues-of-4.1-Billion-Growing-4-Over-2023/default.aspx

https://s22.q4cdn.com/133460125/files/doc_financials/2024/q4/Q4-FY-2024-Crocs-Inc-Transcript.pdf

Disclaimer:

The content provided on this blog is for informational purposes only and should not be construed as financial, investment, tax, or legal advice. All information, data, and material presented herein is believed to be accurate and reliable, but should not be regarded as a complete analysis of any subjects discussed.

All investments involve risk, and the past performance of any investment, investment strategy, or investment style is not necessarily indicative of future results. The value of investments can go down as well as up, and investors may not recover the amount originally investe

The author(s) of this blog are not licensed financial advisors, registered investment advisors, or registered broker-dealers. We do not purport to tell or suggest which securities or investments readers should buy or sell for themselves.